You already know that high-end cars deliver unbelievable speeds, attract attention, and are, of course, expensive. This is exactly why they play by a different set of rules, both on the road and in the insurance world.

If you own an exotic car, a standard auto insurance policy just won’t cut it; you need protection that not only covers your valuable asset but also preserves your peace of mind.

At iLusso, we know these cars inside and out—including what it takes to protect them. That’s why we’re here to break down everything you need to know about exotic car insurance before you buy your next dream car.

What Sets Exotic Car Insurance Apart?

Unlike insuring a family sedan, getting coverage for an exotic or collector car involves higher stakes and stricter standards because the policies are tailored for some very unique needs. Why? High value, rare parts, and non-standard repairs are the norm. Not every insurance agency is up for that challenge.

Premiums on these specialty insurance plans are often much higher, but the right insurance policy means peace of mind if disaster strikes—be it theft, collision, or the unexpected.

Overall, insurance companies that cater to exotic car owners understand how to handle complex liability coverage situations. That is why they are set apart from traditional insurance agencies.

Coverage Options

Insurance coverage options for high-end cars go well past basics like collision and liability. Some unique options include:

- Agreed value and agreed value coverage: Unlike standard auto insurance (which considers depreciation), agreed value coverage ensures that in the event of a total loss, you receive a pre-determined payout. This is especially important for collector cars and classic cars.

- Spare parts protection: Exotic cars often need specialized spares not stocked by every repair shop.

- Roadside assistance specifically for high-performance cars: You don’t want to risk a regular tow truck for your Lambo or Ferrari. Trust us.

- Custom modifications coverage: Aftermarket parts and upgrades should be covered, too.

- Comprehensive coverage tailored for collector cars: This handles theft, flood, and even vandalism, which is key for rare and classic car insurance.

Expect Higher Premiums

Insurers set higher rates for luxury vehicles because:

- Repair costs for an exotic car make typical collision coverage claims look tiny.

- Sourcing rare parts often means longer waits and higher bills.

It’s not just about what can go wrong—it’s about reducing the odds it will and protecting your car’s value. For example, some insurance providers may require your exotic car to be stored in a secure, climate-controlled garage when not in use. They may even inspect your storage facility before setting your insurance costs.

6 Key Factors to Know Before You Buy Insurance

Don’t just pick the first car insurance rates you see. Choosing the right exotic car insurance policy takes planning and some “big picture” thinking. Here are some things to think about and plan for as you buy an exotic car.

1. You May Need Proof of Prior Insurance and Driving History Before Buying

Insurance providers won’t always roll out the red carpet if this is your first luxury car. Many top insurance companies want to see that you’ve had prior insurance on performance vehicles or other high-value cars. A spotless driving record also helps you score better rates. If you’ve got a few fender benders or speeding tickets, your premiums will climb fast.

2. You Might Have Some Usage Restrictions

Think you’ll hit the track every weekend? Think again. Many auto insurance policies for exotic cars exclude racing, track day usage, or high-risk driving events. Many also cap your annual mileage because more miles mean more risk.

- Restrictions on track days: Usually not covered, so you should ask up front if this is something you want.

- Restrictions on mileage: Having lower annual mileage may help reduce premiums—but watch for limits.

3. Your Location May Affect Your Coverage

Where you park your car matters.

Living in areas prone to natural disasters, or places with high theft rates and many uninsured drivers can significantly raise your deductible and annual premiums. Some insurers may require additional coverage, such as wind or flood protection, or proof that your vehicle is properly secured, both against theft and/or protected during hurricanes and storms. In some high-risk zones, coverage may even be denied altogether.

Another consideration is that insurance companies may determine that your car is in a location with limited access to qualified repair shops and spare parts, which can also drive up premiums or limit coverage options.

4. Timing Matters If You’re Financing Your Exotic Car

Planning to finance your supercar? Your lender will want proof of insurance coverage before giving you the green light. Most won’t release funds for a high-end vehicle unless you have a valid insurance policy in place with the right deductible and all coverage options spelled out, including liability and collision.

That being said, it’s crucial to take time to shop for coverage options ahead of getting your heart set on an exotic car. Don’t wait until the last minute and forget about required documents and deadlines—you could end up delaying the purchase of your dream car or losing out altogether.

5. What You Need to Have Ready for the Insurance Company

To make life easier, have your paperwork in order before insurance companies ask for it:

- Vehicle identification number (VIN)

- Photos of the car, inside and out

- Proof of garage or secure storage (photos or certification of your garage and security systems)

- Details about aftermarket or factory modifications

- Prior general insurance history

- History of high-value or exotic auto insurance policies

- Accurate vehicle valuation (usually from a certified appraisal or documentation from the dealership)

- Inspection reports detailing the car’s condition

- Financing documents if you’re taking out a loan

Getting this together speeds up your insurance quote, approval, and the overall buying process. For more tips on buying and owning exotics, see iLusso’s advice at The Truth About Owning Exotic Cars.

6. Who Normally Gets Approved for Exotic Car Insurance?

Most insurance companies look for mature, financially stable buyers with a clean driving record who have owned or managed luxury vehicles before. High-end car buyers often have a long history of working with specialty insurance providers and may own more than one collector car. If you don’t fit this profile, don’t worry. There are lots of different types of exotic car buyers who still get approved by insurance. For a behind-the-scenes look at who typically owns exotic cars, check out this breakdown: Profiles of Exotic Car Buyers.

INSIDER TIPS

Getting the best exotic car insurance takes smart planning, knowledge, and some negotiation. Not every insurance agency offers the right extras, like agreed value or comprehensive coverage, so compare carefully. Sometimes, bundling policies or choosing a higher deductible can lower your premiums, but read the exclusions and small print! Few things are worse than a denied claim after a costly incident.

Tips on Reducing Exotic Car Insurance Premiums

If you want to trim insurance costs, start with these tips:

- Join auto clubs or affinity groups to access group rates with specialty insurance companies.

- Install advanced security systems and trackers to lower theft risk.

- Bundle insurance policies (like home and auto insurance) for discounts.

- Limit your mileage and ask for a low-mileage policy.

- Request agreed value coverage, so you get the full insured amount in a total loss, without a fight over depreciation.

- Only use approved repair shops. This sometimes lowers premiums and guarantees specialty work with genuine parts.

- Compare quotes from specialty providers like Hagerty Insurance and more.

- Opt for roadside assistance and collision coverage tailored to high-value cars

Each savings strategy comes with pros and cons. Raising your deductible helps in the short run, but can be expensive when you need repairs. Dropping extras, like a spare parts rider or roadside assistance, may hurt in an emergency. Always read your policy carefully.

Tips on Picking the Best Exotic Car Insurance for Your Needs

Choosing the right exotic car insurance means looking beyond price. Compare each insurance policy’s liability coverage limits, coverage options, payment on total loss, agreed value features, exclusions, and customer service ratings. Ask about real-world claims experiences and how your insurer handles complex repairs for high-value luxury vehicles.

Be sure to check reviews and ask for recommendations from other exotic car owners, your luxury car club, or even seasoned brokers. The goal is to match your specific needs and usage habits with the best possible protection and service.

Talk to Experts!

Owning a high-end car means enjoying every curve of the road, safely protected and fully informed. iLusso understands luxury vehicles and the unique insurance needs that come with them.

If you want to learn more about exotic car insurance, talk to us. We’re not an insurance agency, but as experts in exotic vehicles, we know that you should expect the best, and we may be able to help.

Ready to Sell? Contact Us

Already own an exotic car and thinking about your next? We’d love to help. Sell your current exotic to us and upgrade to something new and exciting. Let’s make your next driving experience unforgettable—with peace of mind to match.

What’s Your Exotic Worth?

Why deal with the uncertainties of a private buyer or other dealership?

Work with the best in the business!

iLusso is one of the largest automotive buyers of supercars, sports cars, and luxury coupes and SUVs in the United States. We specialize in these luxury vehicle brands: Aston Martin, Bentley, Bugatti, Ferrari, Lamborghini, Koenigsegg, Mercedes-Benz, Maserati MC20, McLaren, Pagani, Porsche, Rolls-Royce, Range Rover, and Audi R8.

Have one of these that you’re looking to sell?

Most Recent Posts

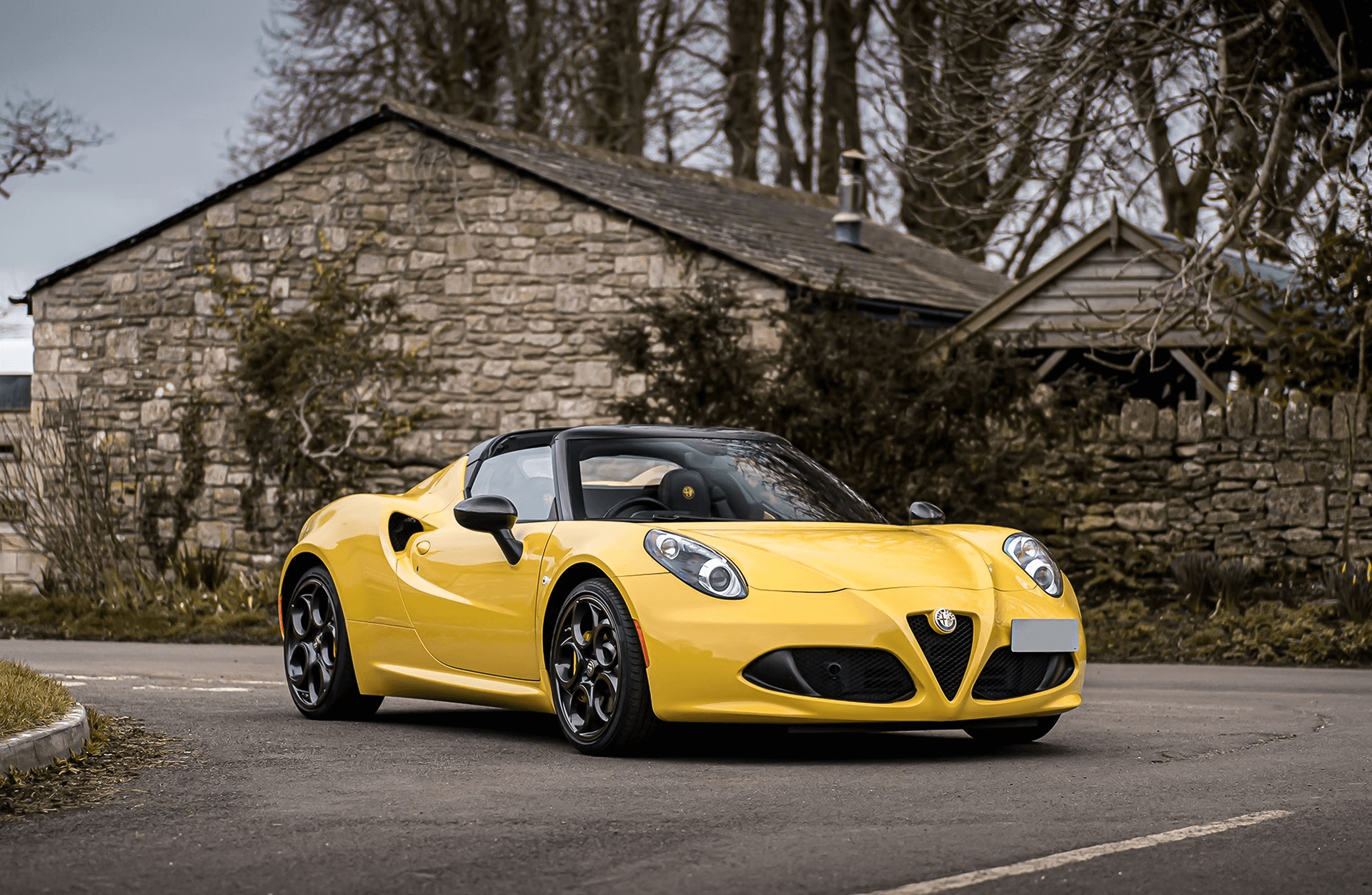

Will the Alfa Romeo 4C Spider Become a Classic Exotic Car?

Monday 30,2022 By aanEditor

Alfa Romeo vehicles have always been among the most sought after and highly collectible cars, so it would be no surprise if there’s another of those with the 4C Spider. If you’re looking to buy an Alfa Romeo, this could be the classic car you should choose. What exactly is it that makes Alfa Romeo’s cars just so good anyway? One of their strongest

Read More

Will New EV Hypercars Become Popular?

Thursday 10,2022 By aanEditor

Electric vehicles (EVs) seem to be the new trend as many people have turned a focus on “going green.” Fully electric vehicles don’t run on a combustion engine, and therefore produce no carbon emissions that are damaging to the atmosphere and the air we breathe. EVs compare nicely to traditionally fueled cars when it comes to things like driving

Read More

Why the Ferrari 458 Is Still A Car Enthusiasts Dream Car.

Wednesday 18,2023 By aanEditor

The Ferrari 458 is a mid-engined sports car produced by the Italian automotive manufacturer Ferrari. The 458 replaced the Ferrari F430, and was first officially unveiled at the 2009 Frankfurt Motor Show. It was succeeded by the Ferrari 488. The 458 is powered by a 4.5-liter V8 engine, which is capable of producing 562 horsepower and 398 lb-ft of torque.

Read More